by Sonya Bernard-Hollins, publisher- Community Voices

KALAMAZOO (MICH.)- When the world was placed on lockdown in March due to the world-wide spread of Covid-19, everyone felt its wrath. Businesses were forced to close, schools went into a virtual mode, and sports…forget it! As Michigan Governor Gretchen Whitmer joined other governors to quarantine their residents to slow the spread of the deadly virus, no one knew just what that meant. For small businesses, the shut down of the economy would bring many to the brink of potential closure. Tao Adedeji, the owner of He Reigns Magazine, was one of those businesses. Already a one-man operation, Adedeji was informed by a vendor, Ralph Jones of RJ’s Printing, of an opportunity to receive $5,000 through a Micro-Enterprise Grant. That referral turned into a blessing. But would it be enough for the black business community?

KALAMAZOO (MICH.)- When the world was placed on lockdown in March due to the world-wide spread of Covid-19, everyone felt its wrath. Businesses were forced to close, schools went into a virtual mode, and sports…forget it! As Michigan Governor Gretchen Whitmer joined other governors to quarantine their residents to slow the spread of the deadly virus, no one knew just what that meant. For small businesses, the shut down of the economy would bring many to the brink of potential closure. Tao Adedeji, the owner of He Reigns Magazine, was one of those businesses. Already a one-man operation, Adedeji was informed by a vendor, Ralph Jones of RJ’s Printing, of an opportunity to receive $5,000 through a Micro-Enterprise Grant. That referral turned into a blessing. But would it be enough for the black business community?

“This was the first time I have ever applied for a grant,” said Adejeji, known to all as simply, Tao. “I didn’t think I would have received it in a million years.”

“This was the first time I have ever applied for a grant,” said Adejeji, known to all as simply, Tao. “I didn’t think I would have received it in a million years.”

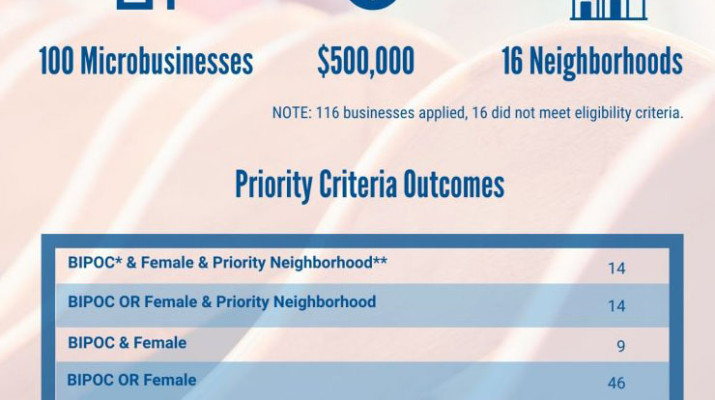

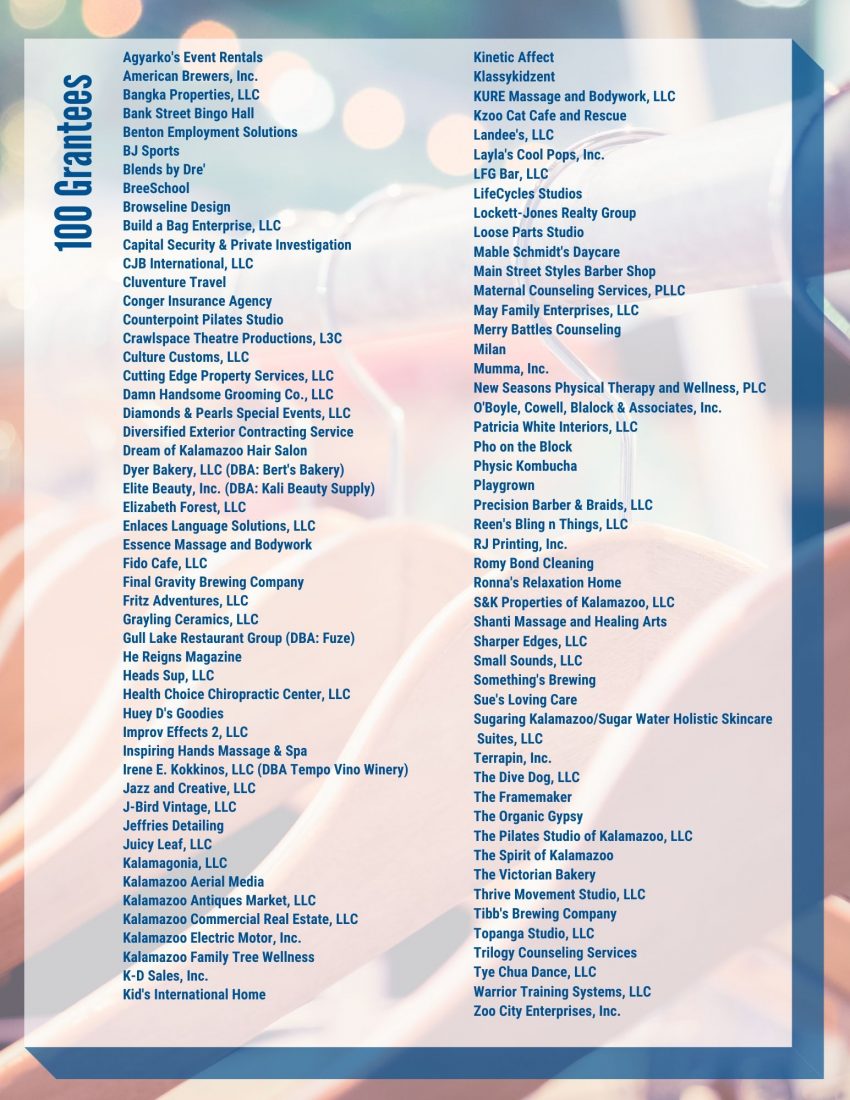

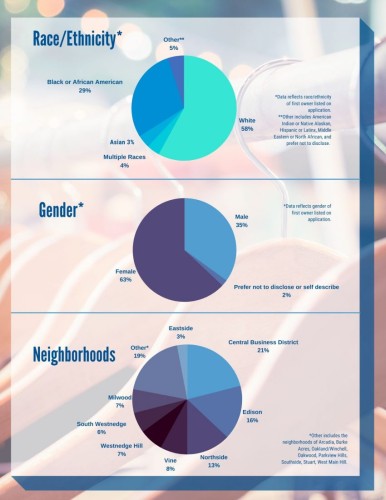

Tao is one of the 29% of Black or African American-owned businesses in Kalamazoo that received one of the 100 grants from the Kalamazoo Micro-Enterprise Grants. The grant was facilitated by United Way of Battle Creek and Kalamazoo Region with funds from the City of Kalamazoo’s Foundation for Excellence and Consumer’s Energy Foundation. A total of $145,000 of the $500,000 went to African Americans. A total of 58% of the funds went to white business owners. While African Americans in the Eastside, Edison, and Northside were targeted for the funds, 13% of the funds went to that demographic with the largest amount, 21% going to businesses in the Central Business District.

Although the numbers are small, 29% is better than 0% according to Nicole Triplett, founder of the Facebook Group, Kalamazoo Black Wall Street. The lack of access and information about grants and loans to minorities was what led her to share the United Way grant opportunity on her platform. The name, Black Wall Street, is derived from the once-prosperous African American community of Greenwood in Tulsa, Oklahoma. The all-black community boasted a business collaborative worth millions in 1921 before whites of Tulsa burned it to the ground. The potential of African-American-owned businesses working for collective wealth is something Triplett is passionate about.

Although the numbers are small, 29% is better than 0% according to Nicole Triplett, founder of the Facebook Group, Kalamazoo Black Wall Street. The lack of access and information about grants and loans to minorities was what led her to share the United Way grant opportunity on her platform. The name, Black Wall Street, is derived from the once-prosperous African American community of Greenwood in Tulsa, Oklahoma. The all-black community boasted a business collaborative worth millions in 1921 before whites of Tulsa burned it to the ground. The potential of African-American-owned businesses working for collective wealth is something Triplett is passionate about.

Her issue with the disparity of economic support of Black-owned businesses came when she learned they were left out of a business funding initiative. The Michigan Economic Development Corporation (MEDC) through Southwest Michigan First was designed to according to its website, “provide grants, loans, or other economic assistance for highly competitive projects in Michigan that create jobs/and or provide investment.” Triplett said local black-owned businesses were not represented. Her social media group allowed her “to address the disparity in funding, which was blatantly apparent when the dispersion of the grant funds from MEDC was announced.” Triplett said she began a series of discussions on the lack of funding for black businesses that have led to barriers through applications of systemic opportunity lock-outs. Her voice was valued by the United Way.

“When speaking with United Way in partnership with the City of Kalamazoo, they listened,” Triplett said. “They turned what was intended to be a loan-only fund into a loan and grant fund and were willing to look at their application process. Black Wall Street Kalamazoo was able to allow Black entrepreneurs the chance to apply as well, and many were awarded.”

“When speaking with United Way in partnership with the City of Kalamazoo, they listened,” Triplett said. “They turned what was intended to be a loan-only fund into a loan and grant fund and were willing to look at their application process. Black Wall Street Kalamazoo was able to allow Black entrepreneurs the chance to apply as well, and many were awarded.”

Twala Lockett-Jones was one of those more than 6,000 group members of the Facebook group, who took advantage of the grant opportunity.

“Nicole does a great job of keeping minority business owners in the loop of resources and opportunities for growth,” said Lockett-Jones, of Lockett-Jones Realty Group (one of the first African American women realtors and brokers in Kalamazoo.) “This grant will allow me to build a website and help with a marketing campaign. I am thankful for this support that was available at such a crucial time.”

Natalie Saucedo of the local United Way was instrumental in the grant distribution and worked with those like Triplett to get the word out to the minority business community. Saucedo, who serves as Director of Individual Giving and Innovation said, while the numbers of minorities who received the grant were low, it was a huge win for the first-time effort. She learned that not many black-owned businesses were interested in the low-interest loan opportunity offered through the Kalamazoo Small Business Loan program the United Way helps oversee to help businesses impacted by the Covid-19 pandemic. The grant program was an opportunity to help those who fit the Asset Limited Income Constrained, Employed (ALICE) category.

Natalie Saucedo of the local United Way was instrumental in the grant distribution and worked with those like Triplett to get the word out to the minority business community. Saucedo, who serves as Director of Individual Giving and Innovation said, while the numbers of minorities who received the grant were low, it was a huge win for the first-time effort. She learned that not many black-owned businesses were interested in the low-interest loan opportunity offered through the Kalamazoo Small Business Loan program the United Way helps oversee to help businesses impacted by the Covid-19 pandemic. The grant program was an opportunity to help those who fit the Asset Limited Income Constrained, Employed (ALICE) category.

The time between the announcement of the grant and the deadline was two weeks. Saucedo said that was strategic in order to get as many people the funds in a short amount of time. While the funds per business were small in total, it was a huge benefit to the Kalamazoo-based small businesses that have less than 10 employees, earn less than $1 million a year, need working capital for operations, and could demonstrate their need due to Covid-19 pandemic. People of Color, those in the Edison, Northside, and Eastside neighborhoods were priority along with women-owned businesses. She reached out to those like Triplett, attended Kalamazoo Community Foundation racial healing collaboratives to share the news, as well as follow-up with businesses in City network directories to inform as many of the dozens of black-owned businesses of the opportunity.

“We are typically not in the business of providing loans or grants to for-profits, but we had the tools, staff, databases, community partners; all the pieces to facilitate these loans and grants. I feel we tapped into as many resources as we could,” Saucedo said. “There is always room for improvement, and we can always find ways to reach more people.”

“We are typically not in the business of providing loans or grants to for-profits, but we had the tools, staff, databases, community partners; all the pieces to facilitate these loans and grants. I feel we tapped into as many resources as we could,” Saucedo said. “There is always room for improvement, and we can always find ways to reach more people.”

Tao is grateful for the grant. His quarterly magazine was founded 14 years ago to highlight the Christian community of Kalamazoo. He founded the magazine as a tribute to his own father who dreamed of being a magazine editor. His magazines sell for $3 each along with subscriptions that help him pay for printing and freelance editors. In the past, he had only applied for a $3,000 loan to celebrate the 10th anniversary of his magazine. Other than that, all of his funds came from the dozens of magazines he sold quarterly. The pandemic left many at home and away from churches, grocery stores, and newsstands where his magazines typically are available. He had to rethink his future business model. The grant helped provide resources to expand his magazine to a digital platform.

Jones, of RJ’s Printing, said, he too was grateful for the opportunity to apply for the grant. He said the process was simple, however, he wished more minority businesses would have received the funds.

“There used to be certain regulations and set-aside funds for minority businesses, but that has all seemed to have gone by the wayside,” said Jones who has owned his own family-operation print shop for more than 20 years in Kalamazoo. “We (African American) businesses have challenges others don’t in receiving contracts and loans. I would like to see this type of grant offered again; possibly for $10,000.”

For more information on business loans available, visit https://www.changethestory.org